When Fitch downgraded the US’s credit rating to AA+, the Biden regime described the timing as «bizarre». Instead, the responsible authorities should look back at 2023 as a pivotal year, and rather use the downgrade as a warning.

The Federal Reserve (Feds) fights against inflation by pushing up interest rates. This heightens the risk of a fiscal crisis after decades of money printing that has exploded under the current president, according to Wall Street Journal.

As a result, the investments that stand the best chance of providing shelter from that storm also happen to be unusually attractive right now.

Historically, investors have not gained much from investing in government bonds. But now the situation may have changed, the WSJ suggests.

Ray Dalio is the founder of the giant hedge fund Bridgewater Associates, and has somewhat undeservedly received credit for the term «cash is trash». But now safe investments, and cash, are a better investment than many of the alternatives, believes Dalio.

– Cash used to be trashy. Cash is pretty attractive now. It’s attractive in relation to bonds. It’s actually attractive in relation to stocks.

It is frightening that people suddenly talk about «cash is king». This usually happens when the economy is heading into a long-term crisis, writes WSJ.

The enormous federal debt, costly climate measures, cCovid-19, money printing, inflation, rising interest rates, millions of migrants pouring in across the border in the south and the war in Ukraine combined with an increasingly divided nation have consequences that also affect the American economy.

True, the US economy seems to be doing better than the EU, which is heading into recession, but how long will the US recovery last? Furthermore, is there a real recovery if economic growth does not beat inflation?

The WSJ suggests that it is already too late to try to save the US economy. The debt will exceed GDP already this year, and as early as 2031 the interest on the debt will exceed all federal expenditure outside the Armed Forces.

Now it is too late. The Congressional Budget Office regularly updates its long-term budget forecasts and says that U.S. debt held by the public will surpass gross domestic product this fiscal year and that interest on that debt will equal about three-quarters of discretionary, nondefense spending. By 2031, it will be as large.

Medicare, Social Security and, of course, interest are legally nonnegotiable. Military spending isn’t really optional either.No wonder the federal government is described as “an insurance company with an army.”

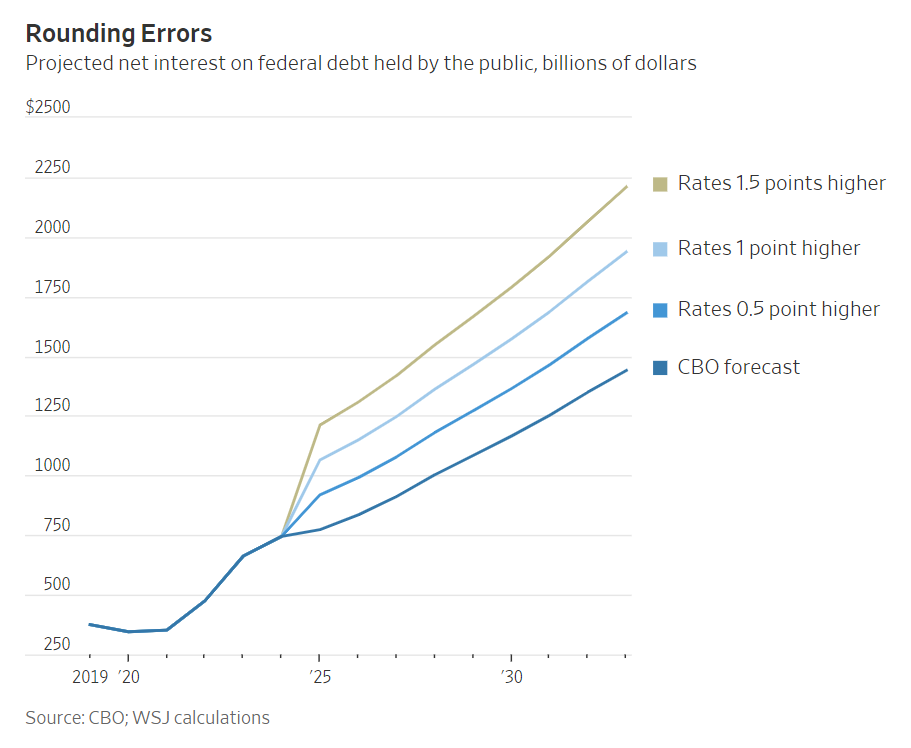

At the same time, the predictions of the Congressional Budget Office are possibly too optimistic, since they assume an interest rate level that may in reality be higher.

It envisions the net interest rate paid on that debt barely topping 3% in coming years even though short-term bills and notes yield more than 5% today

An average interest rate increase of one percent will increase the federal debt by a whopping $3.5 trillion over the next ten years. Only the interest costs will then be $2 trillion annually. Then almost everything that the authorities collect this year goes into income tax ($2,5 trillion).

In such a situation, the entire United States will become like California (or Russia and Argentina). Investors want to escape, just as investors are in the process of escaping from Norway. The richest disappear first, and this means that even if it is only a few people, the sums and the lost tax revenues are significant.

Any countermeasures will ruin business and the middle class, which the WSJ describes as follows.

Just letting rates rise high enough to attract more and more of the world’s savings might work for a while, but not without crushing the stock and housing markets.

At the same time, Washington D.C. will lose freedom of action and, in the worst case, security.

The ability to do things such as bail out banks, underwrite lifesaving vaccines, subsidize cutting-edge technologies or even fight a war would be curtailed.

Less access to money will create a more unstable economy, reduce international prestige and reduce the value of assets in the United States.

It could be a false alarm, writes the WSJ. But they still recommend choosing safe solutions, and trusting the expression that «cash is king», more than it usually is.

Read this also: