The value of the Norwegian krone is in free fall. Over the past year, it is down 14% against the US dollar and a whopping 19% against the euro.

At the same time, Statistics Norway’s official statistics on the consumer price index in the past year is 6.5%. Incidentally, this is a statistic that very few now place their trust in. Everyone notices that prices are rising much more than what SSB tells us. Even the economists have begun to shake their heads at the CPI.

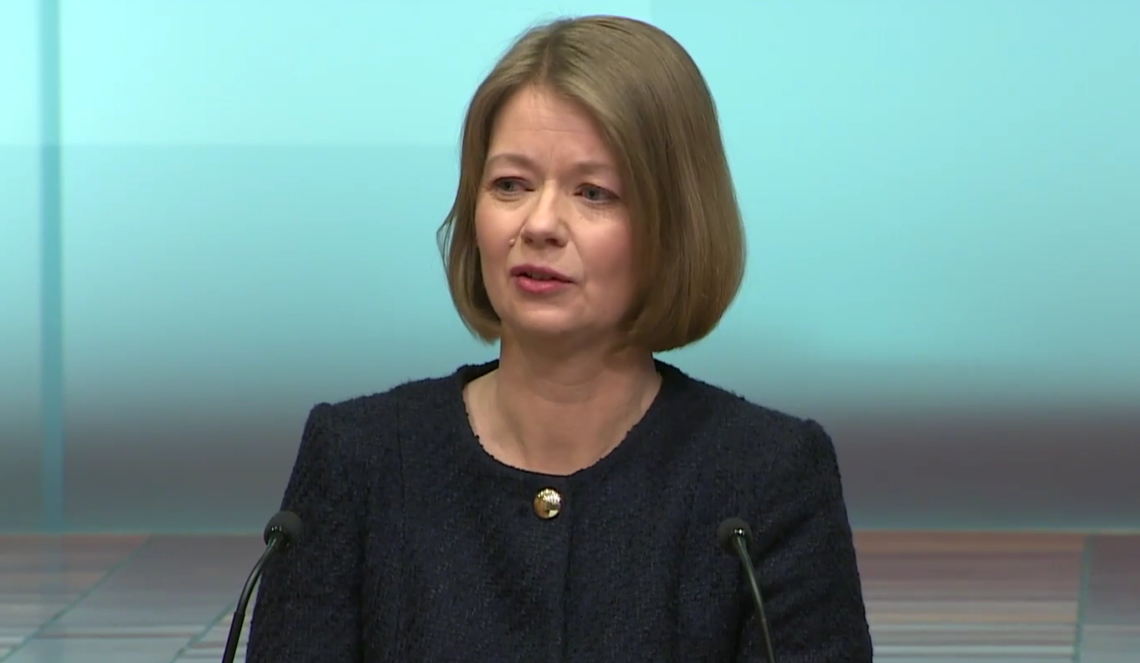

Speaking of the economists, most probably expect that Norges Bank will raise the key interest rate once more next week. This is a political game where central bank leader Ida Wolden Bache is central.

The public are left not understanding why they have been left to be the ones to pay for what is happening. I intend to do something about that.

But first I want to say a little about what money is and what money means to society.

Money is the very foundation of civilization. Money of high value means that we can work closely with other people, even if we do not know them. To put it simply:

I’ll give you a basket of food in return for giving me money. To the next person, you are the one who provides me housekeeping in exchange for me giving you money.

When we do this enough times with each other, we gradually build trust. Once we trust in each other, we can build capital together. When we build capital together – yes, we eventually create a civilization.

Money of low value has the exact opposite effect. It makes us suspicious of each other and it becomes difficult for us to work together to build capital. If we can’t trust the money at all, which happens if it loses value quickly, then civilization will be torn apart in 1-2-3 quick steps.

This is what happens in countries experiencing hyperinflation, that is, when prices rise very quickly and uncontrollably. But we also get the same effect when price inflation is high. Even when the general increase in prices is relatively low, the same thing happens. It is only a matter of differences in degrees.

The state of nature is monetary freedom. That means we can use the money we like best. In its natural state, the total money supply in society will normally be fairly stable. The natural state also means that we are constantly becoming more productive. This means that we are able to produce more and better quality goods and services.

When the same money supply chases more goods and services, prices will fall. The natural state therefore also implies a fall in prices, or what is known as deflation – and deflation means that everyone gets more in return for their work effort. Something that makes people more prosperous over time.

The political condition is not monetary freedom, but monetary monopoly. This means that we have to spend the money that the politicians decide that we have to spend.

The political situation also means that the money supply is increasing. It increases because the politicians want it to increase. When this happens, money continuously loses value. This becomes apparent as general prices rise.

Over a long period of time, the Norwegian state ensures that the money supply increases by a little more than 7% on average per year. This results in a dilution of the monetary value of approximately 7%. Over the course of 10 years, this means that the money’s value is halved. And after 16 years, the value is reduced to a third. The “interest rate effect” is relentless, and after a short time the money has lost almost all its value.

The rapid fall in value means that the money is of very low value. This also causes us to lose confidence in money. We lose trust in it because it cannot store value for us, such as the value of our work effort. In modern Norwegian society, we therefore get rid of the money as quickly as possible. We do this by buying all kinds of junk that we mostly have no use for. So instead of saving money, we incur debt.

We don’t just take out a little loan, we take out a huge amount of loans. Norwegian households have actually ended up at the very top of the world when it comes to utilising credit opportunities. We are only beaten by Denmark.

Norwegians have become debt slaves bathing in a sea of low-quality consumer goods. This is what happens when shitcoins are the only thing we can use.

The reason why politicians want a money monopoly and to increase the money supply is that this is one of the most powerful tools they can use to redistribute values. The redistribution that monetary policy causes is a transfer of value to the state and the riches from everyone else. Monetary policy thus functions as a hidden tax and a hidden subsidy at the same time.

Over time, the effect becomes severe. For example, public spending was only 6% of GDP in 1900, while in 2020 it was a whopping 66%. Other factors such as taxes and duties, are also important reasons for this. But monetary policy is there “at the bottom” and is absolutely crucial for this to happen.

The richest 1% of Norwegians now own 20% of all wealth in Norway. That is to say: Many of them are now on their way to becoming Swiss, having benefited from Norwegian monetary policy for many years.

Central bankers don’t like to talk about the effect that the increase in the money supply has on prices and society – and they never mention the redistribution effect. It is an important part of their job to get people to look away from what they are really doing. Instead, they talk about what they believe are completely different reasons why prices are rising.

In his annual speech on 16 February, Wolden Bache said that price inflation in Norway is due to Russia’s invasion of Ukraine, which “led to a strong increase in energy and raw material prices…which resulted in increased costs for companies, which in turn increased cost prices to consumers.” She also said that “The high price increase is also related to strong demand and little available capacity in the Norwegian economy”. (Bank of Norway)

Wolden Bache, on the other hand, did not mention that Norges Bank had ensured a growth in the monetary supply in the last three years by as much as 30%. In contrast, she said that “A weaker krone results in increased imported price growth.” But she said nothing about the krone sale that Norges Bank is undergoing when they have to exchange tax income from the oil producers before they put the money into the Oil Fund.

Andreas Steno Larsen is one of the world’s most renowned macro analysts. He has repeatedly warned that Norges Bank sells too many kroner in relation to the tax revenue that the state receives from the oil producers.

What Steno Larsen points to here is that Norges Bank increases the money supply in this way, as mentioned at the outset, which has directly led to a fall in the value of the Norwegian krone. Measured against the euro, the dollar and Norwegian goods and services. Steno Larsen tweets have landed on deaf ears. The Norwegian media sat silent for a long time and read his criticism. On 25 April, DN finally understood that they had to comment on the situation. He then stated:

“Realistically, the krone would have been 10 to 15 per cent stronger than at New Year’s if Norges Bank had not sold off krone. They have weakened the currency too much. There is no other significant reason for the price weakening, he states. (Today’s business)

Bjørn Roger Wilhelmsen, who is chief economist at Nordkinn Asset Management, told DN that he agreed with Steno Larsen. As far as I can see, there are no other economists who directly disagree with his analysis. They point to a number of other reasons as well, but they do not deny the effect that the sale has had on the krone.

Norges Bank was given the opportunity to make a statement. It was the press manager who got the difficult job, he did not disagree with Steno Larsen. Instead, he chose, on behalf of Norges Bank, to shrug off responsibility by saying that the krone sale “is based on forecasts from the Ministry of Finance”.

DN did not follow up with difficult questions.

For example, they did not ask the press manager whether this arrangement meant that the central bank had lost its independence. Of course they should have done that.

Norges Bank’s krone sale causes an increase in the money supply. This weakens the value of the krone. Then, of course, prices in Norway continue to be high. This is in accordance with Wolden Bache’s explanation of the reasons for the high price increase, which she blamed on this year’s high import prices.

Norges Bank solves this by raising the interest rate. They do it to force Norwegian households to spend less money, so that the prices of consumer goods and consumer services fall. The consequence of the monetary policy is also that Norwegian banks are running as fast as they can. On 27 April, Nettavisen reported on “Ellevill record for DNB – making huge profits from private customers”.

The Norwegian state owns 34% of DNB. The rest is owned by various investors. Redistribution in favour of the state and the rich therefore continues unabated. Norges Bank gives Norwegian citizens daily what the Americans call a “double whammy”, with a combination of high prices and high interest rates.

In the name of redistribution policy, Ida Wolden Bache, Norges Bank and the Ministry of Finance are in the process of destroying the cornerstone of Norwegian civilization. They manipulate the money supply and slowly but surely destroy our society. They do it in a covert way, none of us were taught anything about this in school and the media doesn’t understand it either.

Monetary policy is therefore a game that only a few understand. There is nothing else to say about this except that the people are being deceived. And with the help of Wolden Bache, the state turns the krone into a shitcoin.

The manipulation of the money supply must end.

The cover of Rune Østgård’s bestseller.

The chronicle was first published on Rune Østgård’s Twitter account and is reproduced with the author’s kind permission. The Twitter post had the following introduction:

Instead of waiting for the newspapers to consider whether to print my articles, I continue to publish here on Twitter. The media are gatekeepers, but I don’t write for them. I write for the people. If you like my chronicle then it’s great.