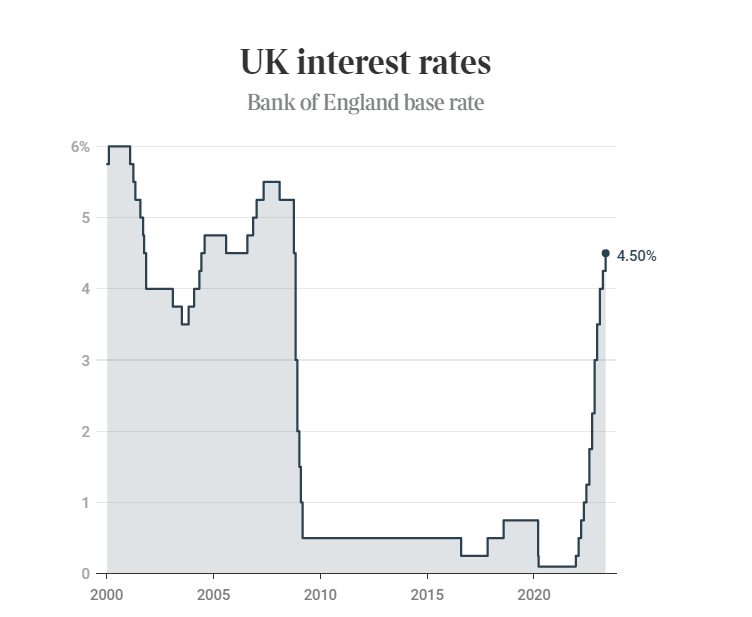

On Thursday, the British central bank raised the key interest rate by a quarter of a percentage point to 4.5 percent. The interest rate has not been this high in 15 years.

This is the twelfth interest rate increase in a row from the Bank of England, writes NTB, which of course points to Ukraine as the only explanation for all the economic problems in Western countries.

Like central banks in a number of other countries, the British bank is struggling to overcome persistently high inflation, fueled by Russia’s war in Ukraine. The war has led to a sharp increase in energy prices, which has spilled over to a number of goods and services.

Self-inflicted energy shortages and costly measures related to the green shift are endlessly ignored. The fact that the bureaucracy is rampant and money is printed in large quantities clearly has no consequences.

Not mentioned are the closures that happened during the pandemic. Inflation is now running at 10.1 percent.

Many people think that an interest rate rise in the UK does not mean much to ordinary Britons, since 85 per cent have fixed interest rates. But according to The Times, there are several million Britons who will have to negotiate a new fixed interest rate for their loans this year.

The rise in the central bank’s interest rate from 4.25 percent will hit millions of borrowers whose fixed-rate mortgages come up for renewal this year and immediately increase monthly repayments for about a million borrowers on variable rate mortgages. The base rate of interest has not been as high as 4.5 per cent since October 2008.

It concerns at least 1.3 million borrowers who will now notice the interest rate increases. In addition, higher interest rates are also felt in companies, with prices being pushed upwards.

At the end of 2021, the interest rate was 0.1 per cent. It should be understood that this is a financial disaster that we are witnessing. Those who have money in savings accounts are not rewarded to the same extent by rising interest rates.

Savers have not benefited to the same extent, with only about 1.4 percentage points of the increased rates from December 2021 passing through to higher returns on deposits, according to data gathered by the Bank.

The consumer price index (CPI) is expected to fall significantly in the coming months, according to the Bank of England. This is not inconceivable, as millions of Britons now cannot afford to buy anything new, after paying for energy and food.

The central bank expects inflation to drop to 3.9 per cent at the end of the year.

The interest rate increases throughout the West are in principle supposed to reduce inflation, but appear to be treating the symptoms, while ignoring the disease. It is not ordinary people who drive inflation, but mismanaged states, the green shift and money printing.

Energy prices have fallen, but many economists expect this to be temporary.

The main reason for the improvement in the growth forecast is the sharp drop in wholesale energy prices, which have fallen to just over a quarter of the level recorded at their peak last year.

Inflation will go down when large parts of the population are ruined.