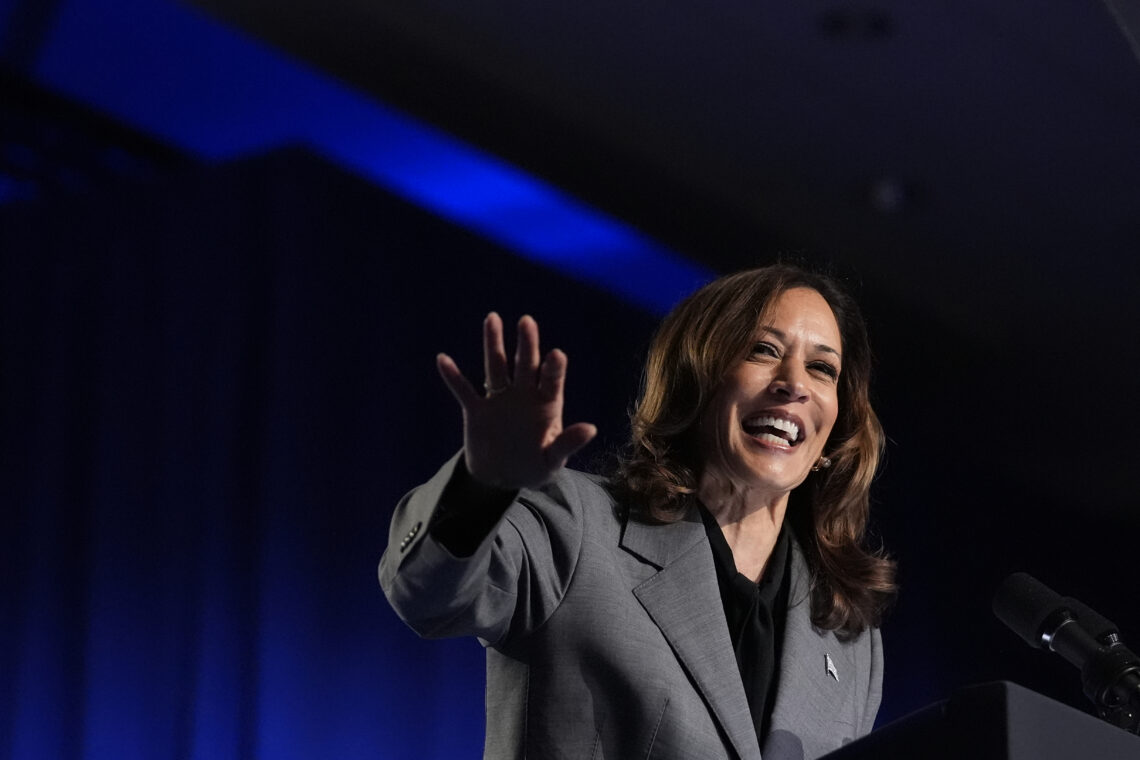

A growing number of wealthy Americans who have donated large sums to Kamala Harris are now beginning to regret it.

Her tax policies will cost them a lot, and not everyone is happy about it.

Democrats love taxes, after all, and last week Harris rolled out a proposal that is causing outrage in certain circles.

Silicon Valley’s wealthiest investors in particular are pissed, according to the Financial Times. The newspaper writes that the elite in Big Tech are shaken by the proposal.

This may be significant, as Big Tech played a major role in Biden’s victory in the last election. In particular, the boycott of Hunter’s laptop story is an outright scandal, and this alone would have ensured Trump’s victory if the media had been honest.

People with more than $100 million in wealth will pay a tax of at least 25 percent, on a combination of income and their unrealised capital gains, according to E24.

Unrealised capital gains mean funds you haven’t yet taken out of the bank. It’s comparable to taxing homeowners on the basis of the rise in the price of the home they’ve already paid off after the state has stolen well over half of their income.

This is also said in the proposal from Harris.

Harris’s proposal is to tax the increase in value of assets, such as shares, bonds, property or investments in start-up companies – even before they are sold. Under the current system, profits are only taxed when the asset is sold, according to NBC.

It’s estimated that those in the top one percent of America’s wealthiest have around 40 percent of their wealth in unrealised capital gains. This can be in stocks, mutual funds and trusts, but also in companies with thousands of jobs.

It is these funds that Harris believes the state, controlled by the Democrats of course, can put to better use.

Harris emphasises that only the super-rich will be affected by the new tax policy. “But the super-rich will of course just run away from the bill, just like Norwegian billionaires do. As a result, the US will lose a large proportion of its tax revenue, and the bill will be passed down to ordinary people.

Vivek Ramaswamy is a good critic of the idea, describing it as a disaster without proportion.

A few weeks ago, I started pointing out that Kamala Harris wants to tax *unrealised* capital gains. The main objection I heard was “she’ll never actually do this.” Now, we’re seeing it’s one of her signature economic policy proposals. pic.twitter.com/6gnD9MSOXy

– Vivek Ramaswamy (@VivekGRamaswamy) August 28, 2024

Biden proposed some similar plans, but failed to follow through. Harris is also likely to face stiff opposition in Congress.

The Committee for a Responsible Federal Budget has estimated that it would bring in as much as $503 billion over 10 years. While that would be only a fraction of the $5 trillion in tax increases that Biden has proposed, his administration has described it as not only economically prudent but also morally necessary.

This is idiot maths. After all, who thinks that wealthy Americans would allow themselves to be robbed in broad daylight? If I remember correctly, the municipality of Asker lost around SEK 200 million in annual tax revenue when Røkke moved to Switzerland.

Of course, race, diversity and gender must be mixed into the madhouse.

“Preferential treatment of unrealised gains is disproportionately advantageous to wealthy taxpayers and gives many wealthy taxpayers a lower effective tax rate than many low- and middle-income taxpayers,” says a document from the Ministry of Finance on the proposal.

“Preferential treatment of unrealised gains also exacerbates income and wealth inequalities, including by gender, geography, race and ethnicity.”

Norways primeminister Støre and chancellor Vedum are surely watching closely.